Unlock clarity.

Accelerate growth.

When time and capital are finite, leaders win by focusing on the few decisions that compound growth and accelerate value.

We provide independent senior judgment that turns complexity into decisive action.

Why clarity & counsel matter

For Board Chairs, CEOs and private equity general partners, clarity is not optional – it’s strategic advantage. Leaders carry responsibility for decisions with significant strategic, financial and reputational impact, often with limited objective internal counsel. Rival Street was established to fill the gap – providing an independent, experienced and trusted voice when and where it matters most.

We help Boards, CEOs and private equity investors unlock lasting value and sustainable advantage by concentrating scarce leadership time, capital and effort on the decisions that matter most.

Our work strengthens conviction, sharpens priorities and supports execution to accelerate value creation.

Senior Advisor to CEOs and Sponsors

Independent, experienced counsel to CEOs, boards and private equity investors - strengthening conviction, pressure-testing priorities and supporting decisive action in high-stakes environments.

Value Creation Execution Support

Practical, hands-on support to accelerate execution against value creation priorities - working alongside management teams to deliver tangible outcomes.

Operating Model & Performance Alignment

Aligning structure, decision rights and performance management to improve focus, accountability and speed of execution. Simplifying complexity and strengthening the link between strategy and delivery.

Growth, M&A & Transformation

Supporting CEOs and investors to deliver growth and transformation - from strategic clarity through to disciplined execution.

Focused Strategy

Clarifying where to compete and how to win - ensuring strategy is focused, actionable and directly linked to value creation.

Alata

Alice

Open Sans

Noto Sans

Bebas Neue

Great Vibes

Rock Salt

Exo

Belgrano

Overlock

Cinzel

Indie Flower

Staatliches

Roboto Slab

Lato

Noto Serif

Open Sans

Montserrat

Ubuntu

Rubik

Delius

Amiri

Montserrat

Deep expertise across retail and institutional financial services - including wealth and asset management, insurance, retirement systems, distribution platforms and adjacent market segments - where capital allocation, customer trust, regulation and operating discipline determine long-term value.

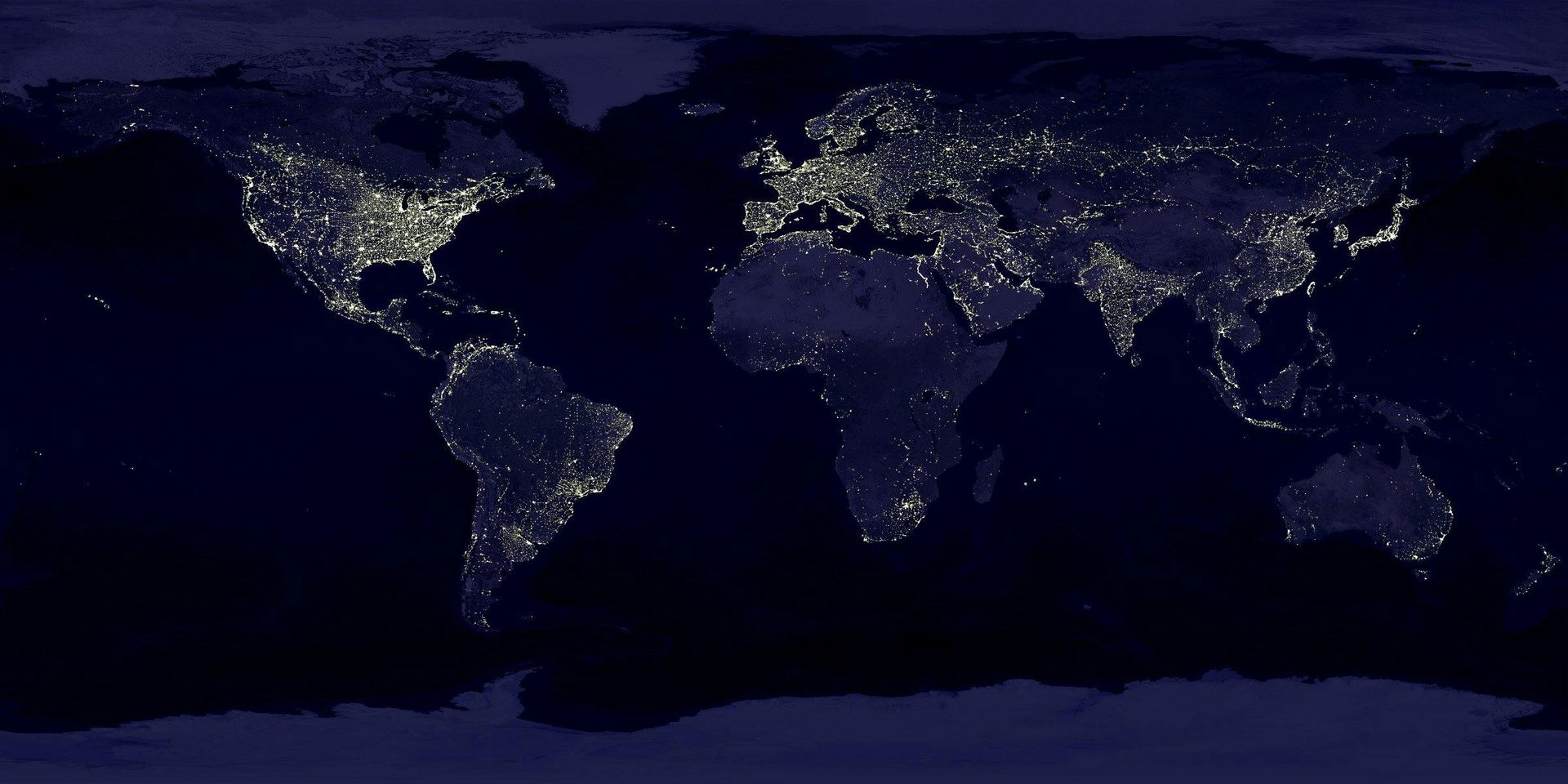

Global perspective combined with operator-level pragmatism

Global perspective matters when it drives better decisions and outcomes

Four decades of lived experience across Sydney, New York, London and Brisbane - spanning diverse markets, regulatory environments and economic cycles. We enable leaders to distinguish where business models translate, where they do not, and how competitive dynamics evolve. With our perspective, leaders can benchmark against what great looks like globally, challenge assumptions, avoid common pitfalls and pursue growth with greater clarity.

Executive and board experience, grounded in real accountability

Executive and board director experience in highly regulated markets brings a practical understanding of how strategy, operating models and governance must align. Having worked across multiple jurisdictions under board and regulatory scrutiny, we provide independent, grounded judgement - helping leaders navigate complexity and build enduring value.